This Insights article was contributed by Chris Massey, CPA (NC License Number 39147), a tax manager at Adam Shay CPA, PLLC.

It has been a wild ride the past few years for Wilmingtonians and North Carolinians alike considering the significant hurricanes and now a global pandemic impacting our community. Typically, with natural disasters and other extraordinary events comes varying degrees of financial relief via new tax legislation. Recently, there have been several new tax laws introduced in order to provide some relief to businesses that have been adversely affected by these events. For businesses in Southeastern NC, this is primarily Hurricane Florence and COVID-19. This article is intended to cover one of these new opportunities, known as the employee retention tax credit.

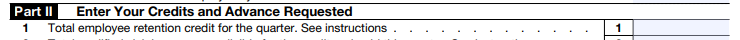

The employee retention tax credit is generally available to local businesses impacted by either Hurricane Florence (and other federally-declared disasters), COVID-19, or both. However, in each case the tax credit has different rules. For example, wages paid by businesses following Hurricane Florence may receive a §38 tax credit – a credit against income taxes – whereas businesses that were impacted by COVID-19 may receive a credit against certain payroll taxes. The latter credit is only available if the taxpayer did not receive a PPP loan, or received it and returned the funds. To further juxtapose these differences, we summarize each credit below.

Hurricane Florence Employee Retention Tax Credit

In December 2019, the Consolidated Appropriations Act, 2020 passed into law allowing an income tax credit for qualified wages paid or incurred following Hurricane Florence. Generally, the credit is calculated as 40% of wages up to $6,000, or $2,400 max for each qualified employee (even if the employee performed services) during the “incident period” set forth as follows.

The incident period starts from the date the business became inoperable and ends the date the business resumed “significant operations” but only up to 150 days following the incident. “Significant operations” is not defined by the Act and depends on the facts and circumstances of each situation. In fact, it is typically easier to provide examples of when significant operations have not resumed, such as:

| Hurricane Florence | COVID-19 | Expanded COVID-19 (Proposed) | |||

| Tax Year | 2018/2019 | 2020 | 2020 | ||

| % of Wages | 40% | 50% | 65% | ||

| Max Wages per Employee | $6,000 | $10,000 | $30,000 | ||

| Max Credit per Employee | $2,400 | $5,000 | $19,500 | ||

| Income Tax Credit | X | ||||

| Federal Payroll Tax Credit | X | X | |||

| Advance Payment | X | X | |||

YMCA Eyes Growth With Plans For New, Expanded Facilities

Emma Dill

-

Apr 23, 2024

|

|

Burns, Redenbaugh Promoted At Coastal Horizons

Staff Reports

-

Apr 23, 2024

|

|

Cold Storage Developer Sets Near-port Facility Completion Date

Audrey Elsberry

-

Apr 24, 2024

|

|

Wilmington Financial Firm Transitions To Wells Fargo's Independent Brokerage Arm

Audrey Elsberry

-

Apr 24, 2024

|

|

Krug Joins Infinity Acupuncture

Staff Reports

-

Apr 23, 2024

|

|

With millions in committed funding from New Hanover County and the New Hanover Community Endowment, along with a land donation from the city...

“My mission and my goal is to take my love of marine science, marine ecosystem and coastal ecosystems and bring that to students and teacher...

Michelle Penczak, who lives in Pender County, built her own solution with Squared Away, her company that now employs over 400 virtual assist...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.