Everyone complains about price increases. On a personal level, we see it with grocery store shopping, filling our gas tanks, receiving our homeowners’ insurance bills and a lot of other expenses that cause complaints. From a business owner perspective, we have regulatory oversight costs, IT costs, HR costs and general supply chain increases that cause our complaints. I would guess that on more than one occasion, you may have experienced an awareness of inflation and grumbled about it – but unfortunately, you haven’t felt inflation, at least not yet.

Here are a few historical prices to frame my comments:

For most of us, it is hard to connect with 1960 prices. Even if you are 70 years young, those prices are hard to remember. You were only 16 and probably didn’t even have your first “real job” yet. You weren’t buying new cars and houses yet.

I don’t think it will be much different for kids turning 16 this year. What will they think about 2014 prices in 2068? Based on history, in another 54 years, today’s costs will be irrelevant.

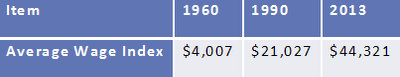

So what’s the point? Take a close look at this line:

This is why we don’t experience inflation. While we are working, prices go up. That includes our price to our employer. We should want inflation, wage inflation, right? Don’t we want to make more income? But does making more really benefit us if everything costs more? Your goal should be to produce wage increases that outpace baseline cost inflation.

Will we see massive inflation in the future or will we be doomed to battle deflation? I will save my economic theory debates for one-on-one time. Let me know if you’d like to join me for coffee and we can delve deeply into the topic. Until then, I will simply state that inflation has happened historically, our policies encourage inflation, and I would count on inflation in the future.

So when will you really experience inflation? When you are no longer participating in the wage-inflation statistic. For most of us, that’s retirement. Retirees have an intimate financial relationship with inflation. They are typically subject only to cost inflation without the benefit of wage increases. Pensions typically don’t have cost-of-living adjustments and Social Security seems to go up just enough to cover Medicare premium increases.

But all hope is not lost. Positioning your assets for growth, such as increasing your equity allocation, can help offset inflation as long as you are comfortable with the risk and have enough time between investment and the need to use the money. If you own rental real estate, you can increase rent. Be mindful that you will also be adding costs of repairs, as well as tax and insurance costs. There are other options for fighting inflation too, but the most important point to remember is that you will have to understand the tradeoffs.

I call inflation the silent retirement lifestyle killer. For the first several years, most new retirees don’t experience, or at least notice, inflation. It seems to erode a lifestyle slowly. The only way to mitigate inflation risk and loss of purchasing power in retirement is to plan for it before retirement.

I showed you prices from 1960 and 1990 for a reason. That is a 30-year span, which is also the typical retirement timeframe. That timeframe also includes periods of high inflation and low inflation, as well as rising and falling interest rates. We have been in a falling inflation environment with some deflationary moments in the 1990 to 2013 numbers. I am not sure that those are the best numbers to use going forward. For those of you that like an annualized number, inflation has averaged around 4.2 percent from 1970 to 2013. That’s the number that I am currently using in our client projections.

As general rule of thumb, prices double every 15 years. That means you will need to double your income every 15 years just to maintain your lifestyle. That’s twice during a typical retirement. And yes, I have heard many arguments from pre-retirees that they won’t be traveling and shopping as much when they are 80 so they won’t need as much money at that age. I agree most people won’t be traveling and shopping as much. However, I would also tell you that I have seen that same money shifting to pay for health care and hiring for services that you once did for yourself.

If you retire at 65 and live to 95, will your plan include inflation protection? Your retirement plan should include tactics for building adequate inflation protection to allow you to enjoy your lifestyle throughout your retirement years. Don’t ignore this silent lifestyle killer.

If you are interested in learning more about our approach to guiding you forward on a path to a comfortable retirement, give me a call or shoot me an email.

Jason Wheeler is currently the CEO and a Wealth Consultant at Pathfinder Wealth Consulting. Pathfinder specializes in comprehensive financial, estate and tax planning services, investment management, and risk management (insurance) for business owners and successful executives. Jason Wheeler offers securities and advisory services through Commonwealth Financial Network®. Member FINRA, SIPC, a Registered Investment Adviser. To learn more about Pathfinder Wealth Consulting, visit www.pathfinderwc.com. Jason can be reached at [email protected], 4018 Oleander Dr. Ste. 2 Wilmington, NC 28403, or 910-793-0616.

Passenger Rail Study Offers New Details About Proposed Wilmington To Raleigh Route

Emma Dill

-

Apr 22, 2024

|

|

Severe Weather Postpones Trump Rally In Wilmington

Emma Dill

-

Apr 20, 2024

|

|

Will NC Be CNBC's Three-time Top State For Business?

Audrey Elsberry

-

Apr 22, 2024

|

Lydia Thomas, program manager for the Center for Innovation and Entrepreneurship at UNCW, shares her top info and tech picks....

Michelle Penczak, who lives in Pender County, built her own solution with Squared Away, her company that now employs over 400 virtual assist...

W.R. Rayson is a family-owned manufacturer and converter of disposable paper products used in the dental, medical laboratory and beauty indu...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.