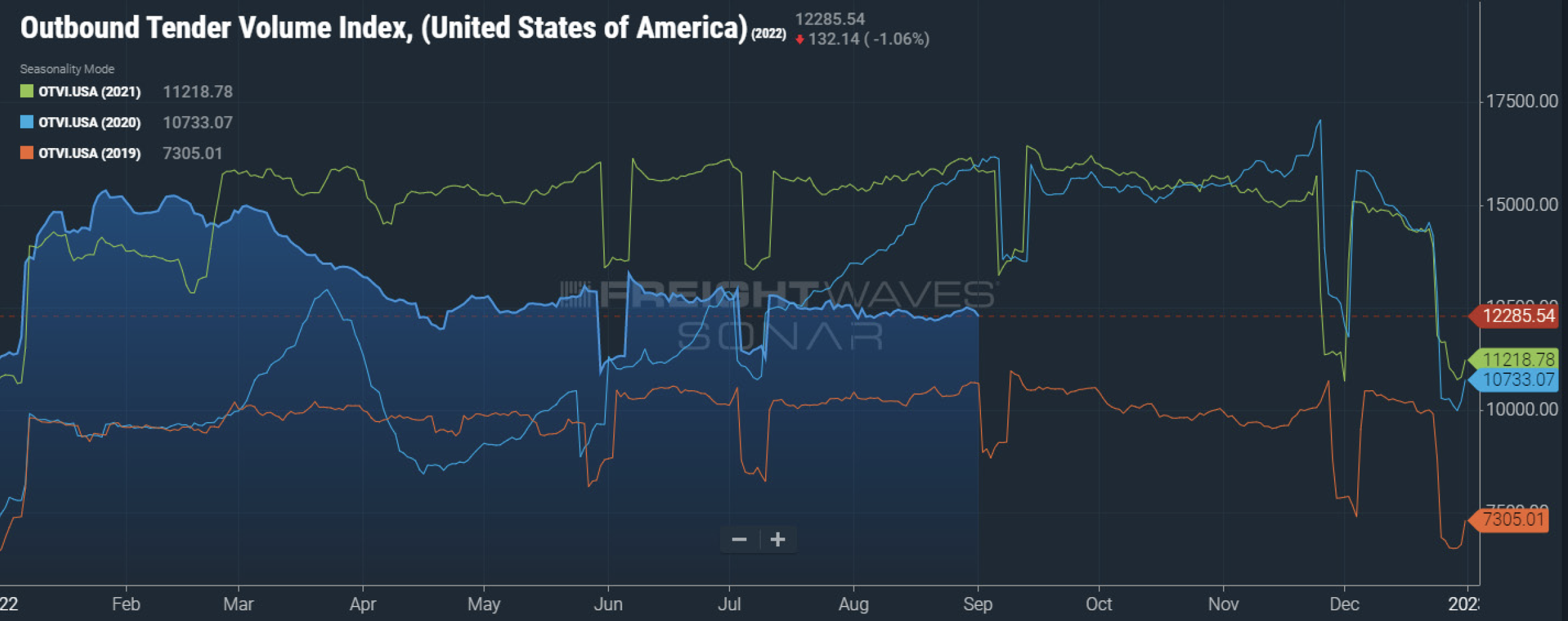

The storm has passed and a repeat of the 2021 capacity crunch is unlikely. As tender volumes hold steady between 2019 and 2021 levels, the industry is adjusting to some residual "kinks" that need to be ironed out.

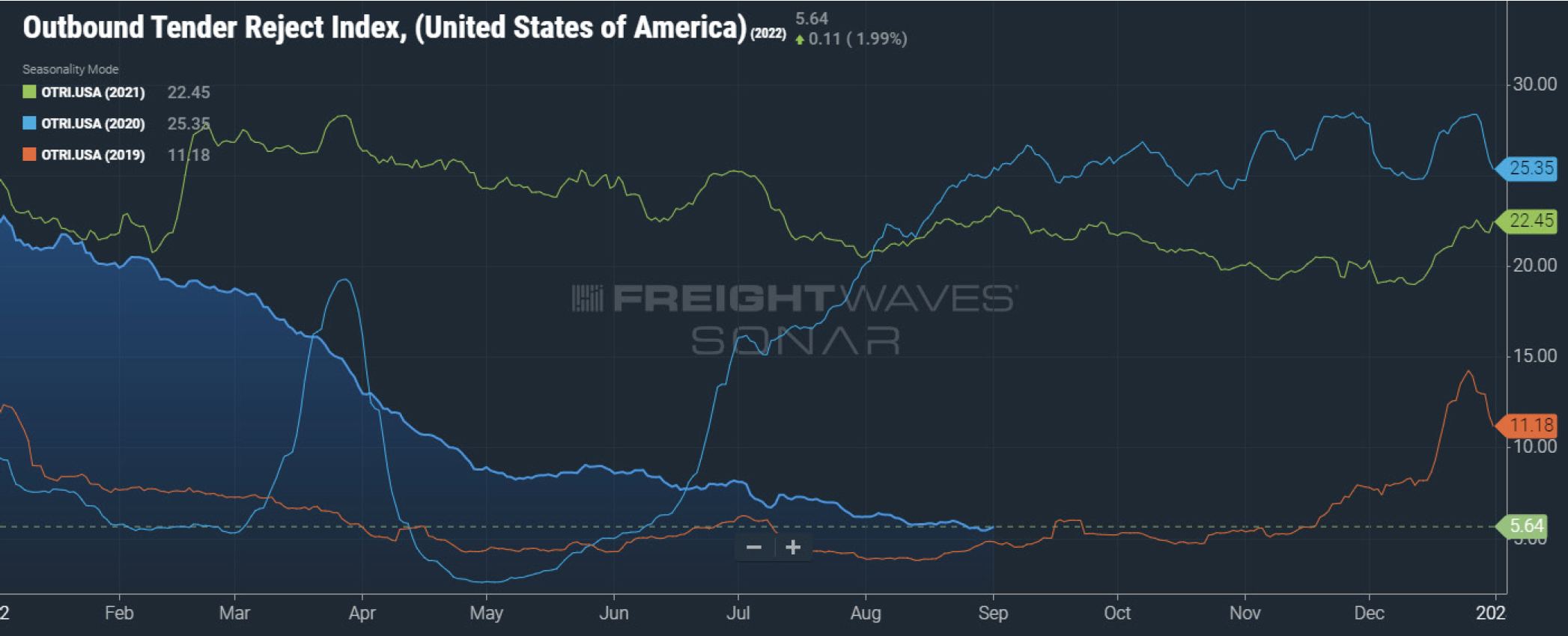

Even though the outbound tender volumes have remained pretty consistent month-over-month since April, as shown in blue on the chart above, rejections have decreased another 7% within the same timeframe. This brings the tender rejections down to 5.64%, which is driving the downward pressure on spot rates in most markets. Tender rejections have not been this low since May 2020, during the beginning of the pandemic. As long as wide-spread hazardous weather doesn't come into play, spot (and contract) rates should not feel any upward pressure until the Thanksgiving holiday. After a volatile couple of years for shippers, the pendulum is swinging back to give more pricing power to the shippers. Even though pricing is different for every lane and commodity, pricing has decreased this quarter, especially since the inverted market (where spot rates out-price the contract rates) became "normal" again.

The inverted market caused the tender rejections to drastically increase because some carriers and logistics companies (outside of MegaCorp) would leave contract loads on the dock, to pick up the higher paying spot loads. Prices also skyrocketed with an increase to over 50% more freight on the road during the pandemic. Just when there was a glimpse of relief, the fuel prices shot up due to the War on Ukraine. Even though prices are still elevated due to the amount it costs to operate a truck now, inflation, and the increased diesel costs, we are happy to report the more "reasonable" rates shouldn't go anywhere anytime soon. Of course they are still elevated from where they were pre-pandemic, but some relief is finally here, in spite of inflation and the high diesel costs that are currently averaging $5.12/a gallon (which is down $0.70 from the highs in June). This decrease caused OPEC nations to announce on 9/5 that they would be cutting production by 100,000 barrels a day, which is being read as a sign that they are willing to make cuts to keep the cost at $100/barrel. This is merely a consistent speculation at this time.

On a slightly similar note worth mentioning, there is a nationwide shortage of carbon dioxide. Large food production companies are searching for gas with urgency and this shortage threatens production ranging from cold cuts to beer. It’s one of the results of pandemic-driven shifts from increased manufacturing production that is being felt in the post-pandemic world. CO2 supplies will remain tight through the fall and could drive up costs of some items.

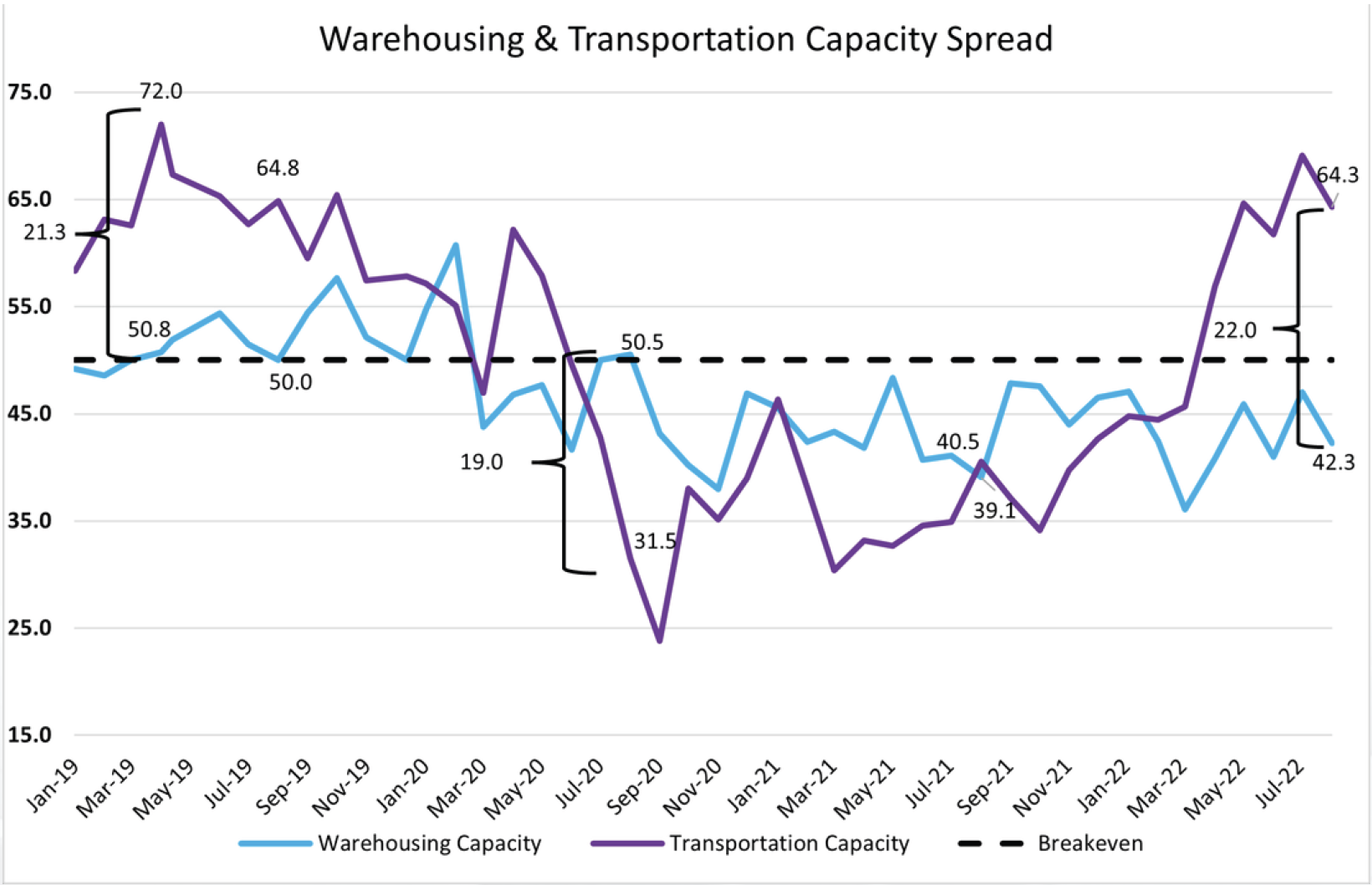

A couple of aspects of the supply chain that are still trying to find balance are the warehousing and inventory levels. Warehousing capacity has decreased for the 24th straight month, with a 3% vacancy rate in the top 30 US markets. Companies cannot risk running inventories down to the point where a repeat of the holiday shortage over the past two years is possible. Some companies have over-ordered and are trying to find the balance of ordering to fill holes while clearing out excess inventory. Additionally, a lot of previous maritime shipments took so long to arrive from overseas that seasonal items missed their season and had to go straight to warehousing. The squeeze on inventory space continues to put strong upward pressures on warehousing prices.

Consumer expenditure is slowing and has returned to being split between tangible items and service/experience based spending. Retailers are aggressively trying to clear excess inventory which is a challenge when disposable income is coming down, savings rates are at their lowest in over a decade, and rising inflation has hindered spending. Many businesses have had to create steep markdowns to move products but it hurts the retailer's bottom line. For perspective, Nordstrom will lose $200M in gross profits in the second half of this year and Target reported a 90% drop in net earnings year-over-year for Q2, which includes canceling $1.5 billion in discretionary orders. Decreased demand and worries of a recession weigh on shippers' inventory levels. However, even with markdowns, inventory levels are still building overall (as well as industrial production) and increasing the cost of warehousing.

With the decrease in warehouse space, some shippers are storing goods on the trailers as a temporary solution. The downside is that this ties up equipment for weeks at a time. The good news is that more trailers have been added into the industry from truck orders that were recently completed stemming from the summer of 2020.

The pandemic put the trucking and logistics industries on the map for many, so much that the trucking industry is up 71,000 jobs over the last year. Some people that were not happy with their jobs during the pandemic left to start a new career as a driver, some found the industry out of necessity due to layoffs, and some that retired during the pandemic have returned. This year the industry has increased driver pay to the average salary of an in-house fleet driver at approximately $70,000 annually, up 11% from 2021. Walmart made headlines in the spring stating that a driver's starting salary would be up to $110,000 a year. The pay increase was long overdue to attract new drivers to the industry and that strategy worked, which is especially helpful with a potential rail strike looming on the horizon.

However, truck driver training programs are in need of more resources and instructors to handle the influx of people interested in joining the industry, so people cannot be on-boarded as quickly as desired.

The ports are catching up with inbound shipments too. The total ships waiting at all of the ports were at 130 ships in the last week of August, down from the 150 we saw in July. Congestion at the California ports isn't making news anymore (apparently the headlining news has been two loads of tomatoes that tipped over in one week in CA)! Currently there are only 8 ships waiting off of the California coast. The congestion making the news still is from the East Coast ports, even though shipments have decreased year-over-year. This has led to situations where truckers cannot even access containers, leading to delays and penalties. The story is not much better once shipments get through the ports, as inland bottlenecks continue to hinder efficiency. Chassis are sitting under idle containers for double or triple the amount of time they should be under normal circumstances. Thankfully we have great connections established at the ports and have continued to be efficient for our drayage clients as well.

As always, MegaCorp is here to help. You can rely on us in any market and trust that we will deliver.

About MegaCorp

MegaCorp Logistics, founded by Denise and Ryan Legg in 2009 with decades of logistics experience, specializes in full truckload shipments (dry van, refrigerated, flatbed), intermodal, drayage, and less-than-truckload shipments throughout the US and Canada. MegaCorp is committed to creating long-term, strategic partnerships with our clients who range from Fortune 500 companies to regional manufacturers and distributors. We serve all business sectors of the US economy including (but not limited to) food, retail, government, textiles and metals/building materials. We strive to offer the best to our clients, transportation partners and employees – you can trust that we'll deliver!

Industrial Building, Land On U.S. 421 Sells For Nearly $12M

Emma Dill

-

Apr 26, 2024

|

Lydia Thomas, program manager for the Center for Innovation and Entrepreneurship at UNCW, shares her top info and tech picks....

Baristas are incorporating craft cocktail techniques into show-stopping coffee drinks, and bartenders are mixing espresso and coffee liqueur...

“Our little town, especially the mainland area, is growing by leaps and bounds. So having somewhere else besides the beach for kids to go an...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.