When thinking about affordable housing, it is important to remember all the elements that make up housing costs. The generally accepted definition of affordable housing is that a household pay no more than 30 percent of its gross income toward the cost of housing. Often this definition is only applied to the rent or mortgage payment and does not factor in the cost of utilities or full cost of insurance associated with home ownership or rent.

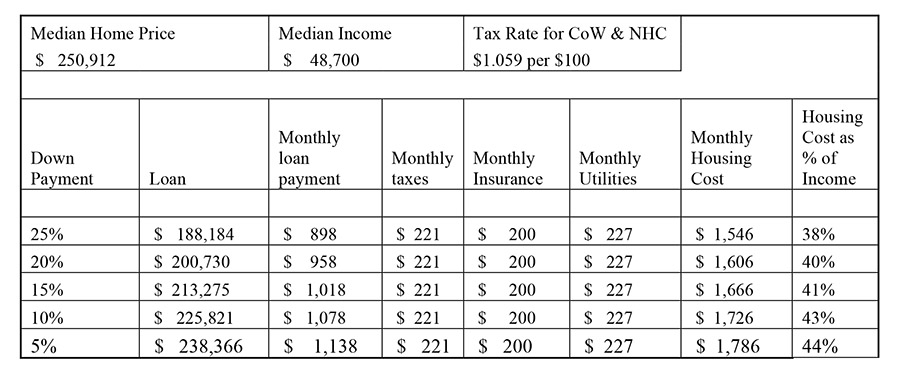

A report sponsored by the Wilmington Regional Association of Realtors and the Wilmington-Cape Fear Home Builders Association offers some interesting statistics. According to the Cape Fear Area Housing and Economic Climate Report 2015-2016, a household earning $48,700, the Wilmington MSA median household income, can afford a single family home at the 2015 average price of $250,912. A closer look at the report is required to recognize some important caveats to meeting the affordability standard, such as having a down payment of up to 25 percent or exceptionally low utility costs of no more than $80 a month.

I would argue that neither of these scenarios represents the average or typical median-income home buyer. Although, someone selling a previous home or receiving an inheritance, gift or other windfall may have a large down payment, it is more likely that coming up with a 10 percent down payment of $25,100 is a monumental task.

It’s likely even more difficult for first-time homebuyers, given the median net worth, excluding home equity, for a married household less than 35 years old is $10,226. A single householder age 35 to 44 has a median net worth of $14,226. Older married households, age 35 to 54, are in a better position, with a median net worth of $43,493. Similarly, single households in the 55 to 64 age range have a median net worth of $45,447. (data source: U.S. Census 2011).

Clearly, some homebuyers with the ability to make a large down payment may not exceed the 30 percent affordability standard. If they do, paying more for housing does not cause them to sacrifice life’s other necessities. For those households earning $48,700, with limited savings, having affordable housing is important to acquiring and keeping housing.

Now consider the average costs of basic utilities, water/wastewater and electricity, in the equation. Below is a table prepared by Steve Spain, executive director Cape Fear Habitat for Humanity, that includes the costs of taxes, insurance and utilities in the computation of affordable housing using the 30 percent definition.

Insurance estimate based on median home with hazard and wind/hail coverage not in flood zone.

Riverlights Could Add 73 More Townhomes To Mix, Site Plans Show

Staff Reports

-

Apr 18, 2024

|

|

Game Over For Michael Jordan Museum At Project Grace

Audrey Elsberry

-

Apr 19, 2024

|

|

City Approvals Push Forward Plans For Former Wilmington Fire Stations

Emma Dill

-

Apr 17, 2024

|

|

Surf City Embarks On Park’s Construction

Cece Nunn

-

Apr 19, 2024

|

|

Taking Marine Science On The Road

Lynda Van Kuren

-

Apr 19, 2024

|

Lydia Thomas, program manager for the Center for Innovation and Entrepreneurship at UNCW, shares her top info and tech picks....

“Our little town, especially the mainland area, is growing by leaps and bounds. So having somewhere else besides the beach for kids to go an...

Baristas are incorporating craft cocktail techniques into show-stopping coffee drinks, and bartenders are mixing espresso and coffee liqueur...

The 2024 WilmingtonBiz: Book on Business is an annual publication showcasing the Wilmington region as a center of business.